Mastering Financial Control: Loan Management within Your Payroll Software

For organizations offering employee loan programs, this module serves as a vital tool for streamlining and organizing all related processes. It manages transactions across various loan schemes, ensuring precision and dependability. Enhance the management of loan programs with greater flexibility, including creating custom loan types tailored to your needs.

Key Features and Benefits of the Loan Management Software

Streamline Loan Processing and Management

Track, manage, and maintain comprehensive records of loan processes with superior accuracy and reliability. Effectively oversee loan schemes with increased flexibility, and utilize a unique module that allows the creation of organization-specific loan types based on your requirements. This solution structures all procedures, facilitates the creation of checklists, manages loan entitlements, various loan types, categories of guarantors, as well as required loan application documents, and seamlessly integrates with your payroll system.

Efficient Loan Tracking

Our comprehensive loan tracking system ensures effective monitoring of loan statuses, significantly reducing the risk of errors in the process. Applicants can apply for loans and conveniently access their complete loan history and current status. Moreover, our system is designed with pre-configured business rules, parameters, and validation methods that seamlessly align with your organization’s specific business roles. This enhances and promotes transparency and accuracy throughout the loan management process, making it a valuable asset for your organization’s financial operations.

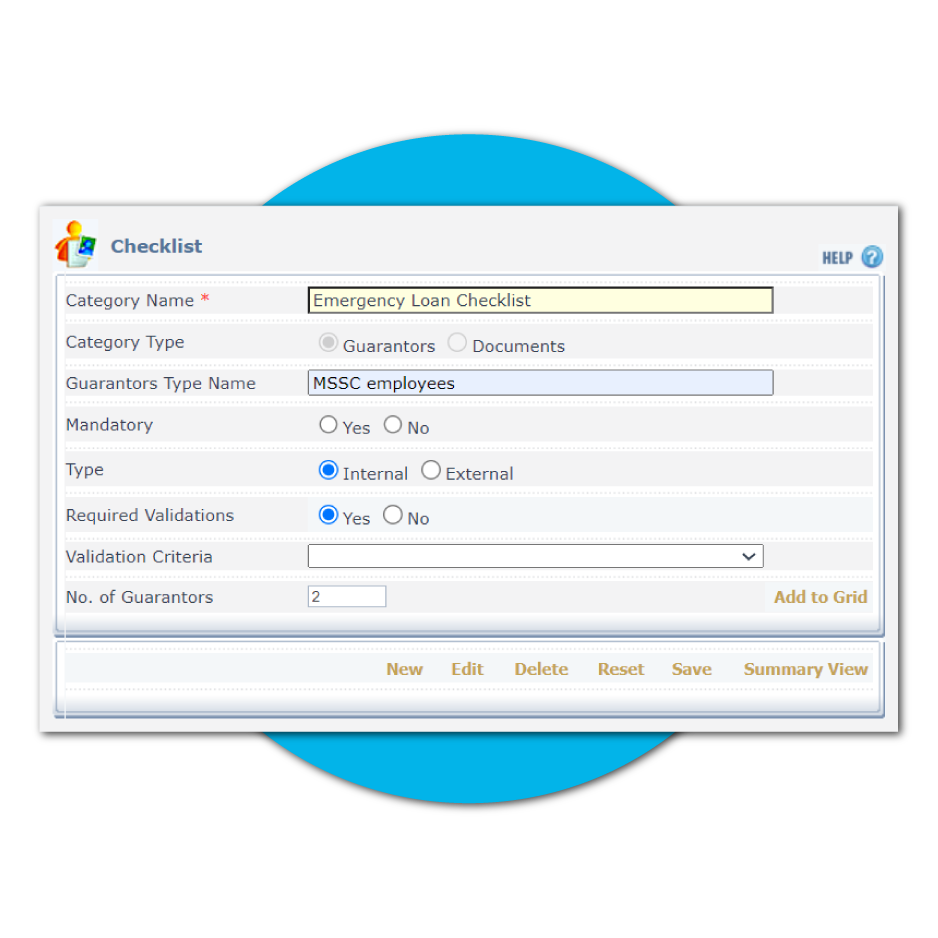

Simplify Document Management

In loan application and processing, effective document management is vital. Our system allows you to maintain all pertinent documents and guarantor information within the platform during application. This streamlines the entire process, reducing the risk of document loss or misplacement, and ensures easy access to all the necessary information at your fingertips. With our document management capabilities, you can improve the accuracy of your loan processing procedures, ultimately leading to a smoother and more reliable experience for your organization.

Product Highlights

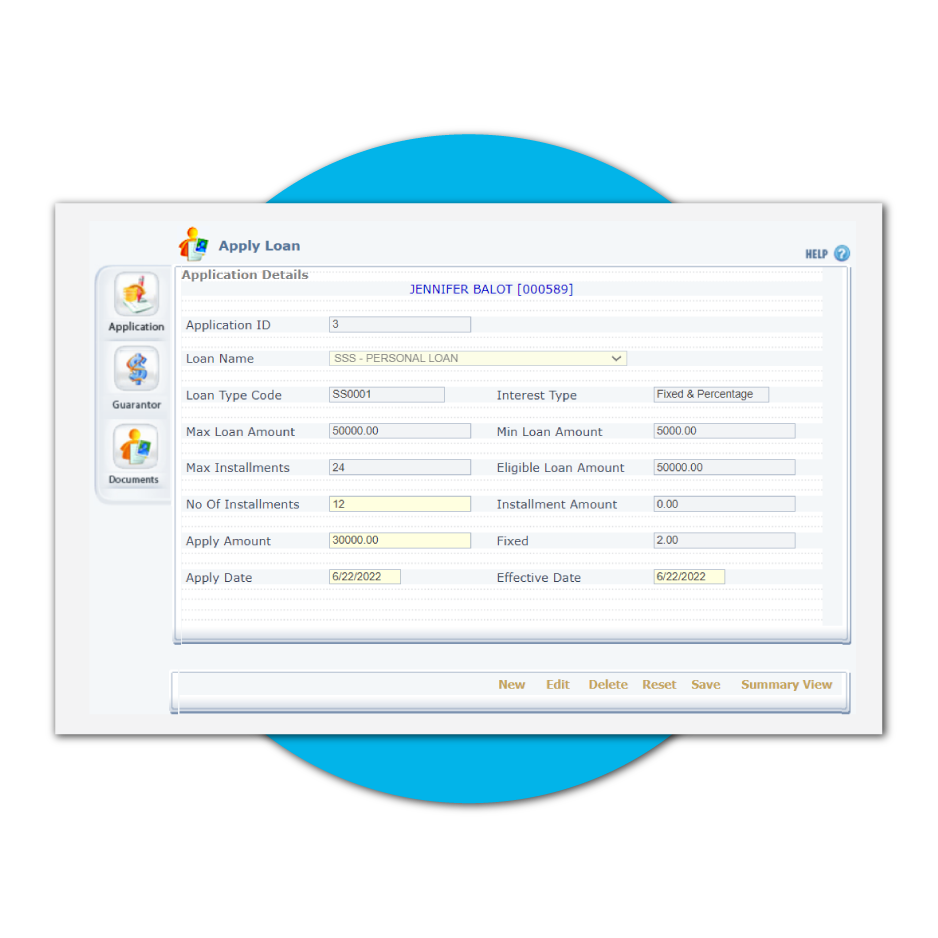

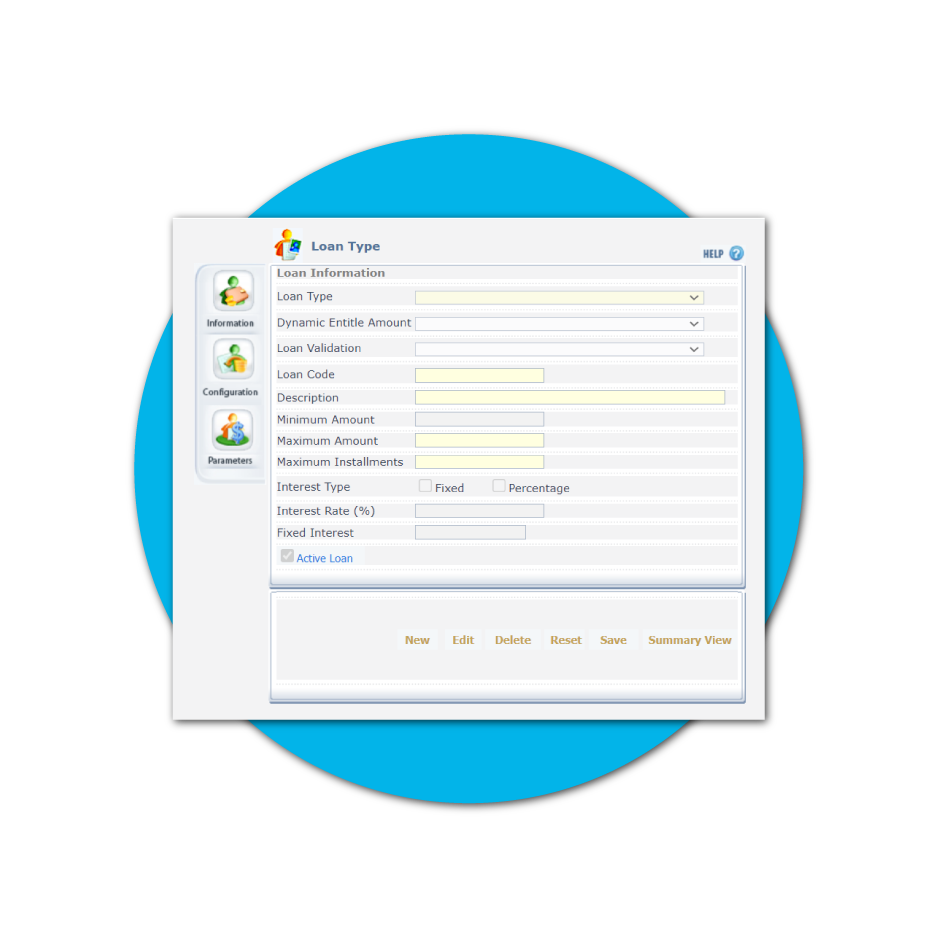

Create Loan Types

Create Different Loan Types, guarantors, and documents

Loan Tracking

Manages documents and tracks loan statuses

Document Management

Maintain all pertinent documents and guarantor information throughout the application

View Loan History

Applicants can apply and view loan history

Impersonation

Apply for loans on behalf of employees

Payroll Integration

Can be Integrated with Payroll

Speedy Processing

Cuts down processing time for loans significantly

Compliance Assurance

Guarantees adherence to necessary loan-related criteria

Minimized Errors

Drastically reduces the chances of errors

Related Modules

Payroll Management

Are you tired of endless hours wrestling with complicated spreadsheets and paperwork to manage your payroll? Say goodbye to payroll stress and inefficiency with our state-of-the-art Payroll Software for the Philippines! Designed to simplify and streamline your payroll processes, transform how you...

Absence Management

Our Payroll Management Software‘s Absence Management system empowers organizations to take control of employee attendance and optimize workforce productivity. With robust tools for tracking and managing absences, our solution ensures accuracy, compliance, and integration with payroll...

Time and Attendance Management

Our Time Attendance software is the cornerstone of workforce discipline and precise payroll accuracy. With robust tools for tracking and managing employee work hours, our solution empowers organizations to enforce policies, optimize resource allocation, and ensure...

Need more information?

Get in touch with one of our product experts today.

Frequently Asked Questions

It’s a dedicated tool for overseeing employee loan programs. It streamlines tracking of multiple loan schemes and offers flexible features like custom loan types, guarantor management, and document tracking—all fully integrated with payroll.

Yes. HR can define custom loan categories—including specific entitlements, guarantor types, and application requirements—to meet unique organizational needs.

The module uses pre-configured business rules, validation checks, and structured workflows to promote precision and reduce the risk of errors in loan disbursement and tracking.

Yes. Employees have self-service access to apply for loans and track their full loan history and current status.

Absolutely. The module centralizes all pertinent loan documents and guarantor details, reducing manual handling and minimizing the risk of lost information.

It seamlessly feeds loan data and deductions into payroll, enabling synchronized tracking, automated amortizations, and accurate pay calculations

Definitely. Through automation, validation rules, and integrated tracking, the system drastically minimizes human error throughout the loan lifecycle.